www.aljazeerah.info

Opinion Editorials, September 2018

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

Mexico's New President, AMLO, to Halt Oil Auctions for at Least Two Years By Nick Cunningham Al-Jazeerah, CCUN, September 2, 2018 |

|

|

|

| Mexico City |

Mexico's New President, AMLO, to Deal Blow to Oil Industry

Mexico will likely halt oil auctions for at least two years, dealing a blow to its oil industry.

Mexico’s president-elect Andres Manuel Lopez Obrador (AMLO) will reportedly suspend oil auctions for at least two years, according to

the Wall Street Journal, with some experts believing that his administration won’t hold any new oil auctions at all during his six-year term. He has also vowed to review the 107 contracts already awarded to companies through auctions over the last few years to check for corruption, although he has said he would not try to invalidate them so long as they check out.Also, AMLO wants to revise some of the energy laws that govern the oil and gas sector, which could dramatically alter the landscape for foreign oil and gas companies. He long opposed the historic reforms that ended seven decades of state control over the energy sector, although he moderated his position during this year’s presidential campaign. Rolling back the reforms would be exceedingly difficult, requiring a change to the country’s constitution.

Instead, AMLO wants more modest, though still significant, legislative changes. The WSJ reports that he will pursue legislative tweaks that bolster the power of state-owned Pemex, while weakening the regulatory body that has pursued a technocratic approach and presided over the oil auctions over the last three years.

AMLO’s desired changes include allowing Pemex to choose its own private-sector partners, without needing the approval from regulators. Current rules require Pemex to partner with the highest bidder for blocks put up for a farm-out. He wants the government to be able to award Pemex with oil blocks directly. And he wants to make Pemex the sole marketer of oil produced by private firms, the WSJ reports.

These changes would amount to a partial rollback of the energy reforms, re-empowering Pemex and government control over the oil sector. Moreover, as president, AMLO chooses the head of Pemex, granting him a lot of leverage over the company. “If licensing rounds are canceled and joint ventures are the only vehicle for entry to the country, it reflects a consolidation of power within” Pemex, Maria Cortez, Latin America Upstream Senior Research Manager at Wood Mackenzie, told

Bloomberg in an email. ”That could be viewed negatively by outside investors.”On top of that, the WSJ says AMLO will push to raise local content rules, which would require a higher percentage of domestic involvement in oil projects. That means that if a company like ExxonMobil or Chevron or some other outside entity wants to drill for oil in Mexico, it would need to source a certain percentage of equipment and services from within Mexico. The idea is to capture a greater portion of the benefits of oil and gas development for the country, while also building up expertise for local industries.

However, many of these changes will be loathsome to the international oil companies, who will view them as onerous burdens that inject higher levels of uncertainty into their investments. Oil companies have repeatedly blamed strict local content rules in Brazil for years of cost inflation and delays.

The most vital industry information will soon be right at your fingertipsJoin the world’s largest community dedicated entirely to energy professionals

“If all of this is confirmed, it would send a signal that the continuity of the oil opening may be in doubt,” Pablo Medina, an analyst with Welligence Energy Analytics, a research firm based in Houston, told the WSJ in an interview.

Meanwhile, in addition to the legislative changes to the energy reforms, AMLO’s core energy plan consists of pouring billions of dollars back into Pemex for oil exploration, with a particular focus on

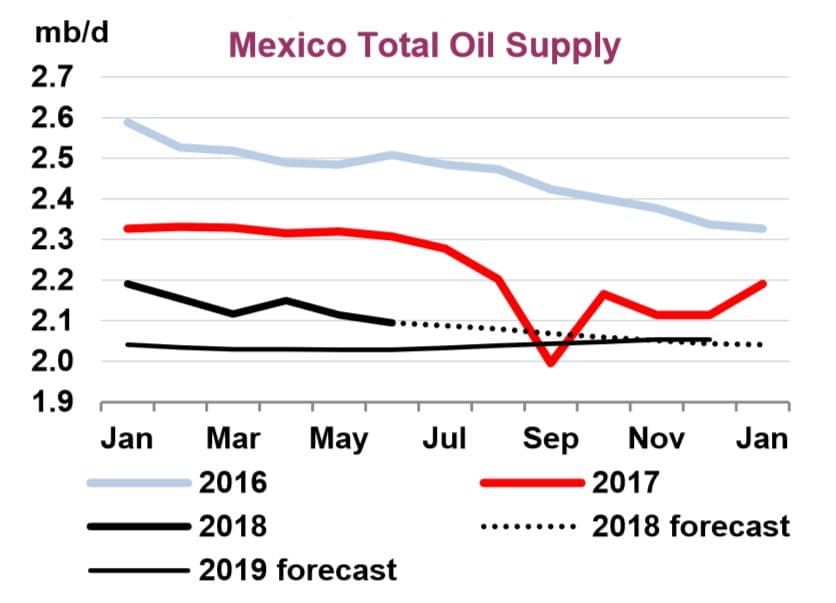

revitalizing the downstream sector. He wants $2.6 billion to rehabilitate Mexico’s six aging oil refineries, plus more than $8 billion to build a new refinery from scratch. The idea is to cut down or even eliminate gasoline imports from the United States.Mexico’s oil production has been declining for over a decade, falling to 1.9 million barrels per day recently, down from 3.4 mb/d in the mid-2000s. The IEA sees output falling by another 130,000 bpd this year, due to the aging offshore oil fields, although that is a narrower decline compared to the 235,000 bpd the country lost last year.

AMLO is aiming to boost production by 600,000 bpd over the next two years, which will be a monumental task. If he is to succeed, AMLO is betting that Pemex will lead the way.

By Nick Cunningham of Oilprice.com

https://oilprice.com/Energy/Crude-Oil/Mexicos-New-President-To-Deal-Blow-To-Oil-Industry.html

***

Share the link of this article with your facebook friends

|

|

|

|

||

|

||||||