The 4 Key Chokepoints For Oil

By Nick Cunningham

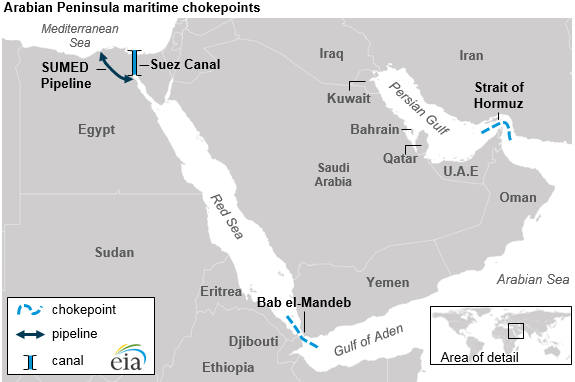

While everyone has been watching the Strait of Hormuz amid rising tension between the U.S. and Iran, a chokepoint on the other side of the Arabian Peninsula is now at the center of the action.

Saudi Arabia temporarily halted all oil shipments through the Bab al-Mandeb strait after Saudi Aramco reported attacks from Houthi rebels on two oil tankers. The two ships in question were very large crude carriers (VLCCs), each carrying 1 million barrels of oil, and one of them sustained minor damage. The Houthis said that they have the naval capability to hit Saudi ports and other targets in the Red Sea, according to Reuters.

In response, Saudi energy minister suspended oil shipments through the strait. “Saudi Arabia is temporarily halting all oil shipments through Bab al-Mandeb strait immediately until the situation becomes clearer and the maritime transit through Bab al-Mandeb is safe,” Khalid al-Falih said. The Kuwait Oil Tanker Company said that it might also suspend tanker traffic through the narrow chokepoint.

The sudden risk to two of the world’s most critical chokepoints has pushed up oil prices a bit this week, although serious outages have yet to materialize.

Nearly two-thirds of the world’s oil trade travels via maritime routes. Here is a quick rundown of the top global chokepoints for the oil trade.

1. Strait of Hormuz. The most vital chokepoint in the world sees nearly 19 million barrels per day (mb/d) of oil traffic, according to the EIA. At its narrowest point, Hormuz is only 21 miles wide. Through that narrow passage, oil exports from Iraq, Iran, Kuwait, Bahrain, Qatar (including large volumes LNG exports), the UAE and Saudi Arabia must pass. The U.S. Navy patrols the area because of its strategic importance. Iran has threatened to disrupt oil traffic through the Strait, but for now the market is assuming that is all bluster.

2. Strait of Malacca. The second most important chokepoint in terms of oil volumes is the Strait of Malacca, between Indonesia and Malaysia, which saw 16 mb/d of oil in 2016. The Strait links the Indian and Pacific Oceans, and is the main route for oil from the Middle East to reach Asian markets. The Strait is only 1.7 miles wide at its narrowest point, “creating a natural bottleneck with the potential for collisions, grounding, or oil spills,” according to the EIA. China, the largest oil importer in the world, has a strategic interest in seeing uninterrupted tanker traffic through the Strait.

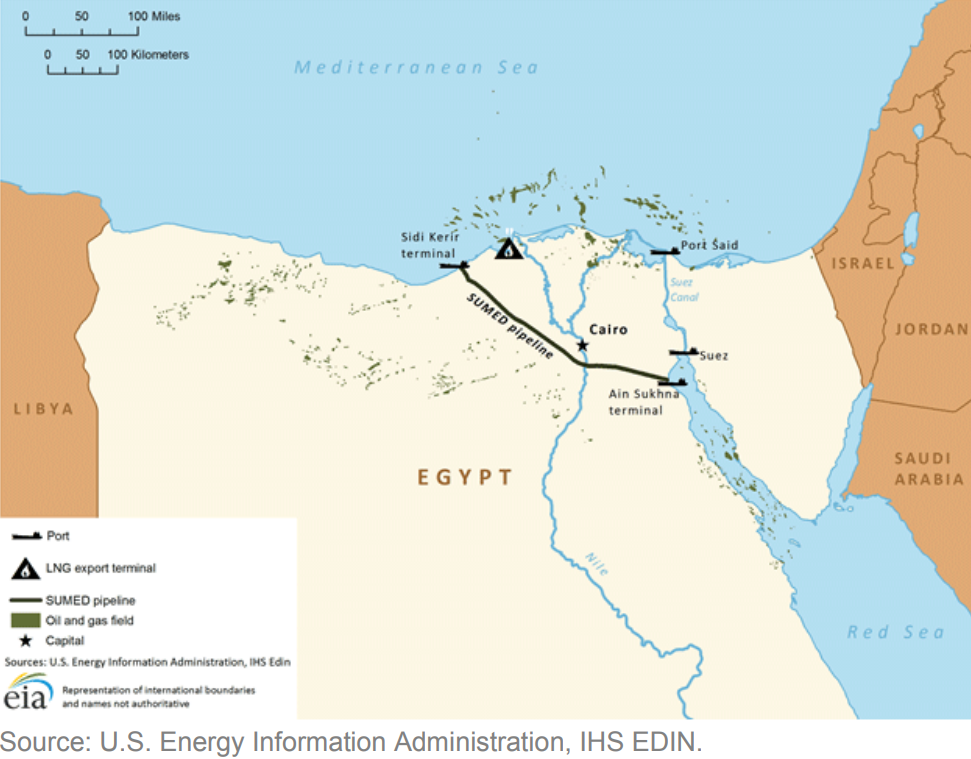

3. Suez Canal and SUMED pipeline. Located in Egypt, the Suez Canal is another crucial chokepoint. Combined with the SUMED pipeline, which bypasses the canal and connects the Mediterranean to the Red Sea, the two routes account for roughly 9 percent of the world’s daily seaborne oil, or 5.5 mb/d. Most of the oil goes north, from the Middle East to Europe. The Suez Canal cannot handle the largest oil ships, ultra-large crude carriers (ULCCs), and it can only handle VLCCs that are not fully laden. As such, VLCCs can offload some of their cargo onto the SUMED pipeline, and then the lighter ship can pass through the canal, picking up the oil at the other end of the pipeline in the Mediterranean. The SUMED pipeline can carry 2.34 mb/d, and offers a hedge of sorts against an outage at the Suez Canal.

(Click to enlarge)

4. Bab el-Mandeb.

The Strait of Bab el-Mandeb is a narrow passage between the horn of

Africa and the Middle East (between Djibouti and Yemen,

specifically). It connects the Red Sea and the Gulf of Aden, or more

broadly, it is the linkage between the Mediterranean and the Indian

Ocean. This chokepoint saw just under 5 mb/d of oil traffic in 2016,

but its importance is magnified for two reasons. First, most oil

that has to pass through the Suez Canal/SUMED pipeline must first

pass through the Bab el-Mandeb, so, tankers have multiple obstacles

on this Middle East-to-Europe route. Second, it is, at this point,

close in proximity to the war in Yemen.

There are a series of other

smaller chokepoints, but these four are the most important in terms

of size of the trade and because of the risk. An outage at any of

these locations, even for a brief period of time, has the potential

to force steep oil price increases, with the effects magnified by

the size and duration of the outage. Even the whiff of a potential

outage, particularly when the oil market is tight, can add a few

dollars per barrel as a risk premium.

***

Tight Oil Markets Are Ignoring Supply Risk

By Cyril Widdershoven

The global oil market is once again in flux as geopolitics and regional conflicts take an increasingly heavy toll on oil supplies. Since the OPEC meeting in Vienna, warning signs that oil markets are heading for a shortage in supply, due to low spare production capacity and growing security threats in and around the Persian Gulf, have not been taken into account.

The perceived oil production increase from the OPEC and Russia agreement has not materialized in full. Analysts are even reporting that the spare production capacity of Saudi Arabia is less than 500,000 bpd.

This lack of production capacity must now become a major point of focus as, in addition to the ongoing Iran-U.S. confrontation in the Strait of Hormuz, Iranian backed Yemeni Houthi rebels have once again attacked Saudi oil tankers in the Red Sea. In response, Saudi Arabia has suspended oil shipments through the Bab El-Mandeb Strait for an undisclosed period of time.

Aramco stated that “in the interest of the safety of ships and their crews and to avoid the risk of oil spill, Saudi Aramco has temporarily halted all oil shipments through Bab El-Mandeb with immediate effect. The Company is carefully assessing the situation and will take further action as prudence demands”.

Even though no casualties have been reported, the current situation is undeniably dangerous and has been escalating this year.

So far in 2018, the Houthis have threatened to increase their attacks on Saudi or Arab Alliance owned vessels. On April 3, a Saudi tanker was shot at with a projectile from Houthi fighters. Several other Houthi attacks have been reported against commercial vessels in the Red Sea and Bab El Mandeb area lately.

The Saudi reaction to these attacks is likely to lead to an upward oil price movement as it has emphasized the level of risk in the area. Around 1.2 million bpd of Saudi oil and petroleum products pass through the strait.

For Saudi Arabia’s customers – this development in undoubtedly going to cause problems. A slowdown of Saudi products to key markets in the U.S. and EU will have an impact on prices. The market may soon realize that the time of secure oil supplies is now behind us.

Tightening supplies and geopolitical risks need to be reassessed and revalued in today’s market. Without high crude storage levels and an almost diminished spare production capacity, the slightest disruptions can start a price run. Bulls have been warning market observers about the tightness of global markets for several months now – yet markets are barely reacting to new outages and threats.

If the Bab El Mandeb situation deteriorates further, putting all other vessel movements at risk, or increasing insurance costs substantially, the market will soon be facing the prospect of a renewed oil price rally.

Shortages in the market have already been forecast, but these were all centered around the prospect of Iran sanctions. If you add to that the tensions in the Bab El Mandeb region, we are looking at a far more bullish market.

While Iran’s threats to close the Strait of Hormuz did stir some fear in analysts, it is not as significant as the Bab El Mandeb area. The Bab El Mandeb is not militarized by U.S.-NATO naval forces – which means it is far more exposed to attacks than the Strait of Hormuz.

Oil markets are already tight and geopolitical tensions across the globe seem to be rising, but the latest development in the Bab El Mandeb Strait should be treated as a key warning sign that analysts need to reevaluate risks in the oil market.

https://oilprice.com/Energy/Crude-Oil/Tight-Oil-Markets-Are-Ignoring-Supply-Risk.html