www.aljazeerah.info

Opinion Editorials, February 2015

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

Why Public Banks Outperform Private Banks:

Unfair Competition or a Better Mousetrap?

Public banks in North Dakota,

Germany and Switzerland have been shown to outperform their private

counterparts. Under the TPP and TTIP, however, publicly-owned banks on both

sides of the oceans might wind up getting sued for unfair competition

because they have advantages not available to private banks.

In November 2014,

the Wall Street Journal

reported

that the Bank of North Dakota

(BND), the nation’s only state-owned bank, “is more profitable than Goldman

Sachs Group Inc.,

has a better credit rating than J.P. Morgan Chase & Co. and hasn’t seen

profit growth drop since 2003.” The article credited the shale oil boom; but

as discussed earlier

here, North

Dakota was already reporting record profits in the spring of 2009, when

every other state was in the red and the oil boom had not yet hit. The later

increase in state deposits cannot explain the bank’s stellar record either.

Then what does explain it?

The BND turns a tidy profit year after year because it has substantially

lower costs and risks then private commercial banks. It has no

exorbitantly-paid executives; pays no bonuses, fees, or commissions; has no

private shareholders; and has low borrowing costs. It does not need to

advertise for depositors (it has a captive deposit base in the state itself)

or for borrowers (it is a wholesome wholesale bank that partners with local

banks that have located borrowers). The BND also has no losses from

derivative trades gone wrong. It engages in old-fashioned conservative

banking and does not speculate in derivatives.

Lest there be any doubt

about the greater profitability of the public banking model, however, this

conclusion was confirmed in January 2015 in a report by

the Savings Banks

Foundation for International Cooperation (SBFIC)

(the Sparkassenstiftung für internationale

Kooperation), a non-profit organization founded by the the Sparkassen

Finance Group (Sparkassen-Finanzgruppe) in

Germany. The SBFIC was formed in 1992 to

make the experience of the German Sparkassen – municipally-owned

savings banks – accessible in other

countries.

The Sparkassen were

instituted in the late 18th century

as nonprofit organizations to aid the poor. The intent was to help people

with low incomes save small sums of money, and to support business

start-ups.

Today, about half the total assets of the German banking system are in the

public sector. (Another substantial chunk is in cooperative savings

banks.) Local public banks are key tools of German industrial policy,

specializing in loans to the Mittelstand, the small-to-medium size

businesses that are at the core of that country’s export engine. The

savings banks operate a network of over 15,600 branches and offices and

employ over 250,000 people, and they have a strong record of investing

wisely in local businesses.

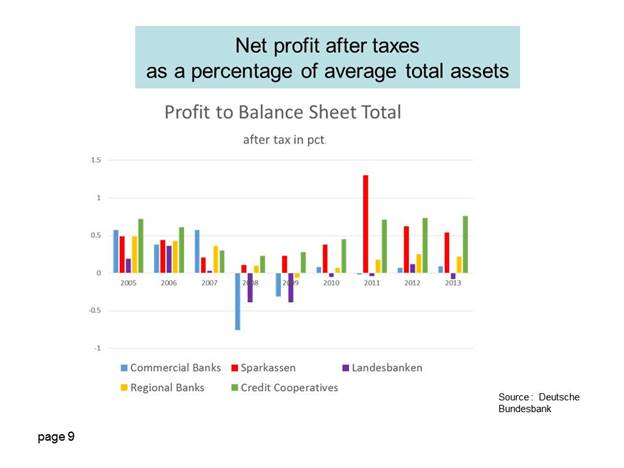

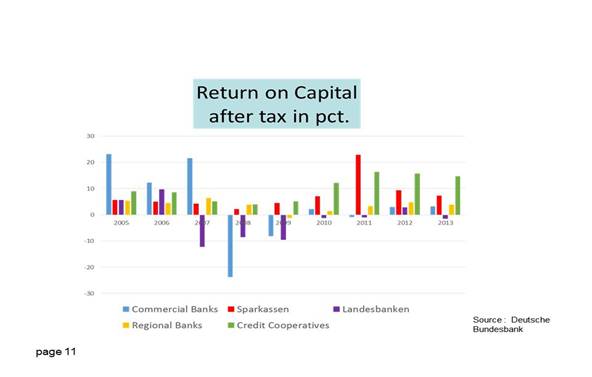

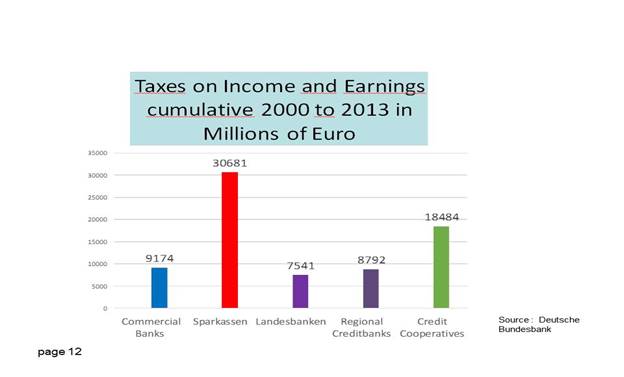

In January 2015, the SPFIC published a report drawn

from Bundesbank data, showing that the Sparkassen not only have a return on

capital that is several times greater than for the German private banking

sector, but that they pay substantially more to local and federal

governments in taxes. That makes them triply profitable: as

revenue-generating assets for their government owners, as lucrative sources

of taxes, and as a stable funding mechanism for small and medium-sized

businesses (a funding mechanism sorely lacking in the US today). Three

charts from the SBFIC report are reproduced in English below. (Sparkassen

results are in orange. Private commercial banks are in light blue.)

___________________________________________________________________________

Swiss Publicly-Owned Banks

and the Swiss National Bank:

The Swiss

have a network of cantonal (provincially-owned) banks that are so similar to

the Sparkassen banks that they were invited to join the SBFIC. The Swiss

public banks, too, have been shown to be

more profitable than their private counterparts.

The Swiss public

banking system helps explain the strength of the Swiss economy, the

soundness of its banks, and their attractiveness as a safe haven for foreign

investors.

The unique structure of

the Swiss banking system also helps explain the surprise move by the SNB on

January 15, 2015, when it

lifted the cap on the Swiss franc as against the

euro, anticipating the European Central Bank’s move to embark on a massive

program of quantitative easing the following week. Switzerland is not a

member of the EU or the Eurozone, and the Swiss National Bank (SNB) is

not like other central banks.

It is 55% owned by the country’s 26 cantons or provinces. The remaining

investors are private. Each canton has its own publicly-owned cantonal bank,

which provides credit to local small and medium-sized businesses.

In 2011, the SNB pegged the Swiss franc to the euro

at 1 to 1.20; but the value of the euro steadily dropped after that, and the

SNB could maintain the peg only by printing Swiss francs, diluting their

value to keep up with the euro. The fear was that once the ECB started its

new money printing program, the Swiss franc would have to be diluted into

hyperinflation to keep up.

The SNB’s unanticipated action imposed heavy losses

on speculators who were long the euro (betting it would rise), and the move

evoked criticism from the European central banking community for not tipping

them off beforehand. But the loyalty of the Swiss National Bank is to its

cantons, cantonal banks, and individual investors, not to the big private

international banks that drive central bank policies in other countries.

The cantons had been complaining that they were no longer receiving the

hefty 6% dividend they had been able to count on for the previous century.

The SNB promised to restore the dividend in 2015, and lifting the cap was

evidently felt necessary to do it.

Publicly-owned Banks

and the Trans-Pacific Partnership

The SBFIC is working particularly hard these days to

make information and technical help available to other countries

interested in pursuing their beneficial public model, because that model has

come under

attack. Private international competitors are pushing for regulations

that would limit the advantages of publicly-owned banks, through

Basel

III, the European Banking Union, and the Transatlantic Trade and Investment

Partnership (TTIP).

In the US, the current threat is from the TransPacific Partnership (TPP) and

its European counterpart the TTIP.

President Obama, the

Chamber of Commerce, and other corporate groups are

pushing hard for fast track authority to

pass these secret trade agreements while effectively bypassing oversight

from Congress.

The agreements are being sold as promoting trade and

increasing jobs, but the effect of international trade agreements on jobs

was evident with NAFTA, which hurt US employment more through the

competition of cheap imports than helped it with increased exports.

Moreover, only five of the TPP’s twenty-nine chapters are about trade. The

remaining chapters are basically about getting government off the backs of

the big international corporations and protecting their profits from

competition. Corporations would be authorized to sue governments that passed

laws protecting their people from corporate damage, on the ground that the

laws impair corporate profits. The trade agreements put corporations before

governments and the people they represent.

Particularly targeted are government-owned industries, which can undercut

big corporate prices; and

that includes publicly-owned banks. Public banks are true non-profits

that recycle earnings back into the community rather than siphoning them

into offshore tax havens. Not only are the costs of public banks quite

low, but they are safer

for depositors; they allow

public infrastructure costs to be cut in half

(since the government-owned bank can keep the

interest that composes 50% of infrastructure costs); and they provide a

non-criminal alternative to an international banking cartel caught

in a laundry list of frauds.

Despite these notable benefits, under the TPP and

TTIP,

publicly-owned banks might wind up getting sued for unfair competition

because they have advantages not available to private banks, including the

backing of their local governments. They have the backing of the government

because they are the government. The government would be getting sued for

operating efficiently in the best interests of its constituents.

To truly eliminate unfair competition, the giant

monopolistic multinational corporations should be broken up, since they have

an obvious unfair trade advantage over small farmers and small businesses.

But that outcome is liable to be long in coming. In the meantime, fast track

for the secretive trade agreements needs to be vigorously opposed. To find

out how you can help, go to

www.StopFastTrack.com or

www.FlushtheTPP.org.

____________________

Ellen Brown is an attorney, founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt. Her latest book, The Public Bank Solution, explores successful public banking models historically and globally. Her 200+ blog articles are at EllenBrown.com.

***Share this article with your facebook friends

|

|

|

|

||

|

||||||