www.aljazeerah.info

Opinion Editorials, March 2012

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

Oh Canada!

Imposing Austerity on the World's Most Resource-Rich Country

By Ellen Brown

Al-Jazeerah, CCUN, April 2, 2012

Even the world’s most

resource-rich country has now been caught in the debt trap.

Its once-proud government programs are being subjected to radical

budget cuts—cuts that could have been avoided if the government had not quit

borrowing from its own central bank in the 1970s.

Last week in Ottawa, the Canadian House of Commons

passed the federal government’s latest round of budget cuts and austerity

measures. Highlights included

chopping 19,200 public sector jobs, cutting federal programs by $5.2 billion

per year, and raising the retirement age for millions of Canadians from 65

to 67. The justification for

the cuts was a massive federal debt that is now over C$ 581 billion, or 84%

of GDP.

An

online budget game furnished by the local newspaper the Globe and Mail

gave readers a chance to try to balance the budget themselves.

Possibilities included slashing transfer payments for elderly

benefits, retirement programs, health benefits, and education; cutting

funding for transportation, national defense, economic development and

foreign aid; and raising taxes.

An article on the same page said, “The government, in reality, doesn’t have

that many tools at its disposal to close a large budgetary deficit. It can

either raise taxes or cut departmental program spending.”

It seems that no gamer, lawmaker or otherwise, was

offered the opportunity to toy with the number one line item in the budget:

interest to creditors. A chart

on the website of the Department of Finance Canada titled “Where

Your Tax Dollar Goes” showed interest payments to be 15% of the

budget—more than health care, social security, and other transfer payments

combined. The page was dated

2006 and was last updated in 2008, but the percentages are presumably little

different today.

Penny wise, Pound Foolish

Among other cuts in the 2012 budget, the government

announced that it would be discontinuing the minting of Canadian pennies,

which now cost more than a penny to make.

The government is focusing on the pennies and ignoring the pounds—the

massive share of the debt that might be saved by borrowing from the

government’s own Bank of Canada.

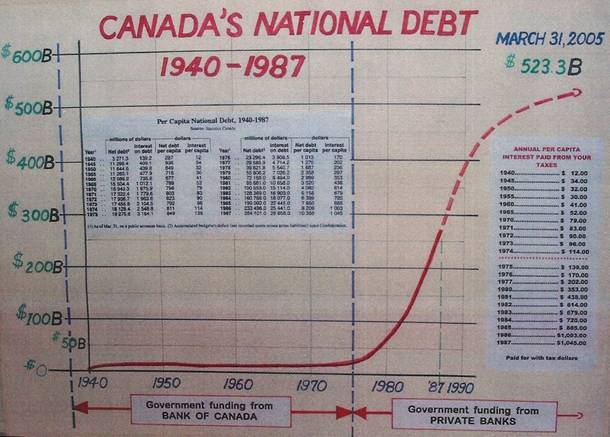

Between 1939 and 1974, the government actually did

borrow from its own central bank.

That made its debt effectively interest-free, since the government

owned the bank and got the benefit of the interest.

According to figures supplied by Jack Biddell, a former government

accountant, the federal debt remained very low, relatively flat, and quite

sustainable during those years.

(See his

chart below.) The

government successfully

funded

major public projects simply on the credit of the nation, including the

production of aircraft during and after World War II, education benefits for

returning soldiers, family allowances, old age pensions, the Trans-Canada

Highway, the St. Lawrence Seaway project, and universal health care for all

Canadians.

The debt shot up only after 1974.

That was when the Basel

Committee was established by the central-bank Governors of the Group of

Ten countries of the Bank for International Settlements (BIS), which

included Canada. A key

objective of the Committee was to maintain “monetary and financial

stability.” To achieve that

goal, the Committee discouraged borrowing from a nation’s own central bank

interest-free, and encouraged borrowing instead from private creditors, all

in the name of “maintaining the stability of the currency.”

The presumption was that borrowing from a central bank

with the power to create money on its books would inflate the money supply

and prices. Borrowing from

private creditors, on the other hand, was considered not to be inflationary,

since it involved the recycling of pre-existing money.

What the bankers did not reveal, although they had long known it

themselves, was that

private banks create the money they lend just as public banks do.

The difference is simply that a

publicly-owned bank returns the interest to the government and the

community, while a privately-owned bank siphons the interest into its

capital account, to be re-invested at further interest, progressively

drawing money out of the productive economy.

The debt curve that began its exponential rise in 1974

tilted toward the vertical in 1981, when interest rates were raised by the

U.S. Federal Reserve to 20%. At

20% compounded annually, debt doubles in under four years.

Canadian rates went as high as 22% during that period.

Canada has now paid over a trillion Canadian dollars in interest on

its federal debt—nearly twice the debt itself.

If it had been borrowing from its own bank all along, it could be not

only debt-free but sporting a hefty budget surplus today.

That is true for other countries as well.

The Bankers’ Silent Coup

Why are governments paying private financiers to

generate credit they could be issuing themselves, interest-free?

According to Professor Carroll Quigley, Bill Clinton’s mentor at

Georgetown University, it was all part of a concerted plan by a clique of

international financiers. He

wrote in Tragedy and Hope in 1964:

The powers of financial capitalism had another

far-reaching aim, nothing less than to create a world system of financial

control in private hands able to dominate the political system of each

country and the economy of the world as a whole. This system was to be

controlled in a feudalist fashion by the central banks of the world acting

in concert, by secret agreements arrived at in frequent private meetings and

conferences. The apex of the system was to be the Bank for International

Settlements in Basel, Switzerland, a private bank owned and controlled by

the world's central banks which were themselves private corporations.

Each central bank . . . sought to dominate its

government by its ability to control Treasury loans, to manipulate foreign

exchanges, to influence the level of economic activity in the country, and

to influence cooperative politicians by subsequent economic rewards in the

business world.

In December 2011, this charge was echoed in a

lawsuit filed in Canadian federal court by two Canadians and a Canadian

economic think tank.

Constitutional lawyer Rocco Galati filed an action on behalf of William

Krehm, Ann Emmett, and COMER (the Committee for Monetary and Economic

Reform) to restore the use of the Bank of Canada to its original purpose,

including making interest free loans to municipal, provincial and federal

governments for “human capital” expenditures (education, health, and other

social services) and for infrastructure.

The plaintiffs state that since 1974, the Bank of Canada and Canada’s

monetary and financial policy have been dictated by private foreign banks

and financial interests led by the BIS, the Financial Stability Forum (FSF)

and the International Monetary Fund (IMF), bypassing the sovereign rule of

Canada through its Parliament.

Today this silent coup has been so well obscured that

governments and gamers alike are convinced that the only alternatives for

addressing the debt crisis are to raise taxes, slash services, or sell off

public assets. We have

forgotten that there is another option: cut the debt by borrowing from the

government’s own bank, which returns its profits to public coffers.

Cutting out interest has been

shown to

reduce the average cost of public projects by about 40%.

Game over: we win.

________________________

Ellen Brown is an attorney and president of the Public

Banking Institute,

http://PublicBankingInstitute.org .

In Web of Debt, her latest of eleven books, she shows how a private

cartel has usurped the power to create money from the people themselves, and

how we the people can get it back. Her websites are http://WebofDebt.com and

http://EllenBrown.com .

The Public Banking Institute’s first conference is April 26th-28th in

Philadelphia.

|

|

|

|

||

|

||||||