www.aljazeerah.info

News, April 2020

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

|

Editorial Note: The following news reports are summaries from original sources. They may also include corrections of Arabic names and political terminology. Comments are in parentheses. |

Coronavirus:

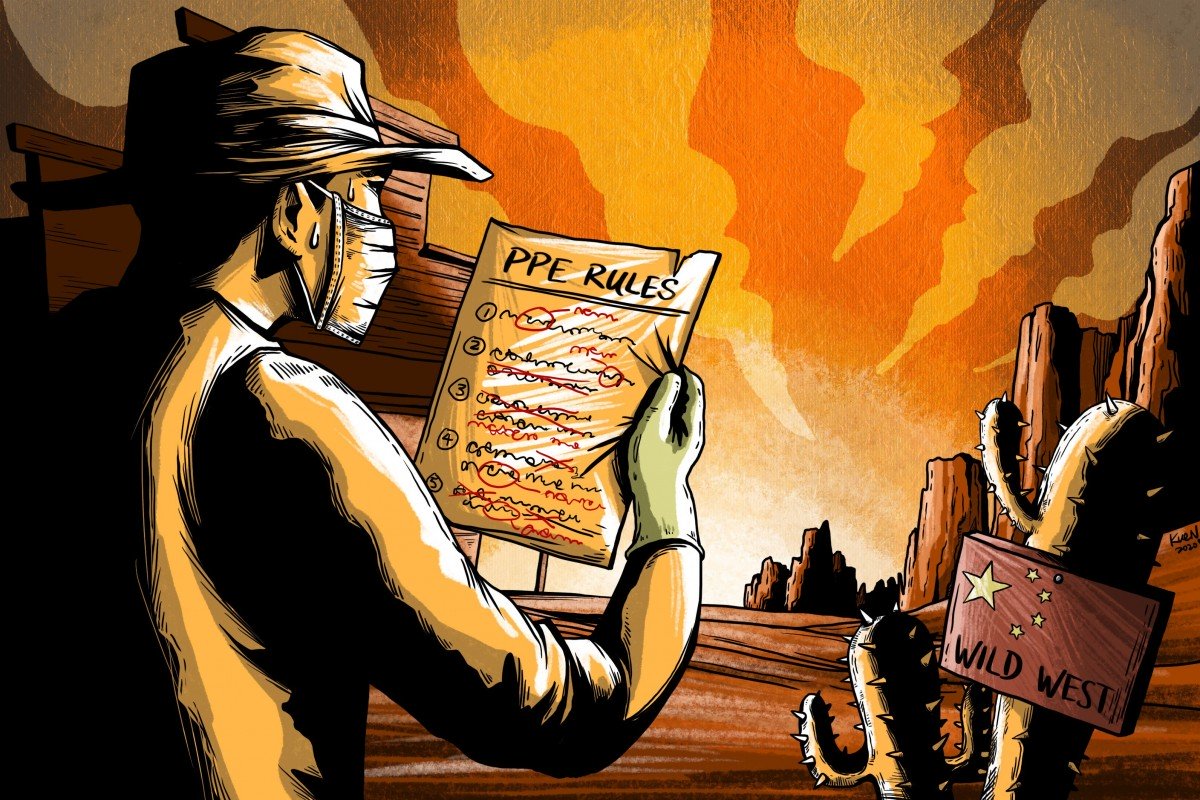

Inside China's 'Wild West', Where Mask Machines Are Like Cash Printers

SCMP, April 17, 2020

|

|

| Medical equipment crucial to containing the coronavirus is being sold and resold in China by unscrupulous middlemen, April 17, 2020 |

Coronavirus: inside China’s ‘Wild West’, where ‘mask machines are like cash printers’

The coronavirus has led to an unprecedented seller’s market for masks and medical supplies in China, redrawing the rules of engagement An influx of new companies to the market has led to a dilution of quality and a host of bad actors, forcing China to change the rules

Finbarr Bermingham

and Cissy ZhouPublished: 10:00pm, 17 Apr, 2020

A “wild feeding frenzy” is under way in China for medical equipment crucial to containing the spread of the deadly coronavirus around the world.

Scalpers stake out factories with suitcases loaded with cash to secure millions of surgical masks hot off the production line. Dealers trade ventilators back and forth as if they were cargoes of coal, before they finally reach the end buyer carrying eye-watering mark-ups.

Governments wire eight-figure sums of money for vital equipment only to lose out to another government that was quicker to produce the cash.

We are slap bang in the middle of a gold rush for the year’s most sought-after commodities – masks, gloves, thermometers, ventilators, hospital beds, testing kits, hazmat suits, hand sanitiser and goggles – and according to those involved in the scramble, there are no holds barred.

The amount of money in the industry is amazing, it moves so fast. Due diligence is sometimes not an option Fabien Gaussorgues

“This is the Wild West – the rules are being rewritten every day,” said Fabien Gaussorgues, co-founder of Sofeast, a quality control inspection company in Shenzhen.

“The amount of money in the industry is amazing, it moves so fast. Due diligence is sometimes not an option – people don’t have time. It is complicated on every side.”

As he spoke, Gaussorgues was scanning a 25-page request for quotation from the United Nations, which wants to buy vital medical supplies to send to developing countries.

But rather than lighting up at the prospect of a mega export deal, his reaction suggests frustration at yet another public institution unprepared for a market that will probably have changed by the time he has finished reading the document, let alone put a proposal together.

“This is so much detail, I can barely manage it. They are not adaptable, they don’t understand the market,” said Gaussorgues, who has been inspecting products in China for a decade, but still feels as though he is in uncharted waters. “Things like these take time to set up – maybe a month.”

Some China-made coronavirus test kits and face masks rejected as ‘unreliable’ in European countries

Others have learned the hard way that in the Wild West, you must move quickly.

On the eve of China’s Ching Ming Festival on April 4, one US state was in the process of buying ventilators from a Chinese factory in China. As is now often the case, the seller required full payment in advance, according to consultants who worked on the deal.

Unaware of the public holiday in China, or of the speed with which the market was moving, the procurement office wired an eight-figure sum on the Friday, when banks were closed. The money arrived on Tuesday, at which point the ventilators had been sold to someone else.

“If you wait more than 24 hours, or spend a few days going through due diligence, or try to visit the factory or at least get samples, the supply has gone, the broker has switched to another supplier. You have to start the process all over again,” said Ben Kostrzewa, a Hong Kong-based trade lawyer at Hogan Lovells, who is working with various US states and hospital systems to source masks and respirators.

The situation has created the ultimate seller’s market, with more Chinese firms starting to make masks and other equipment every day. Some manufacturers are demanding deposits even for factory visits, samples or to see their licensing documents.

National and local governments are scouring the planet for medical supplies to contain their own coronavirus outbreaks, sometimes employing consultants on the instructions to buy from “anywhere but China”, sources said, due to a backlash against Chinese-made equipment and also geopolitical considerations.

But with alternative sources like South Korea, Singapore, Vietnam and Thailand restricting exports of these products, China, with its vast and growing capacity to make personal protective equipment (PPE), is often the only choice.

More than 38,000 new companies have registered to make or trade face masks in China since the beginning of 2020, compared to 8,594 in the whole of 2019, according to Tian Yan Cha, a company registry.

Face mask shortage amid coronavirus pandemic reminds world of China’s manufacturing dominance

The figure has snowballed as export orders dry up in other sectors due to coronavirus lockdowns overseas. Now, plants that were making golf balls, vape pens and car parts are making masks, because it is quick, easy and you can turn a profit within two weeks of production.

The scale of the influx can be seen through the exponential growth of Foshan Hosng Packaging Machinery Co, a food packaging manufacturer in Guangdong which only started making mask making equipment on February 26, and is now churning out 50 full production lines per month.

“At present, the market demand is very large, our production capacity has been operating at full capacity, and we cannot accept new orders until early-May,” said Zhu Huiqing, company director. “Our current production capacity can make 50 fully automated production lines of face mask-making machines, priced at about 1.2 million yuan.”

This surge of new entrants has diluted product quality, over which China has faced a severe backlash overseas, leading it to tighten up export rules. It has also led to a seemingly endless roster of unscrupulous individuals out to make a quick buck.

On a single day in March, the founder of law firm Harris Bricken, Dan Harris, spoke to three separate people who had each lost north of US$1 million on mask export deals.

Someone even called me and offered US$50,000 for our list of mask suppliers. We can’t sell it as we’d lose our bar license, but it would also be as unethical as hell Dan Harris

In one case, an American businessman had taken out a million-dollar loan to advance to a long-term Chinese textiles supplier, who wanted to make masks, but needed the capital to do so. The supplier disappeared with the money, leaving the businessman “all but catatonic with depression”, Harris said.

In another, a buyer placed a million-dollar order for facial masks but ended up getting “dirty Halloween masks” instead.

“I am getting 40 emails a day from people wanting to know where to get masks. They don’t want to help, they want cheap products to sell at a mark-up,” Harris said.

“Someone even called me and offered US$50,000 for our list of mask suppliers. We can’t sell it as we’d lose our bar license, but it would also be as unethical as hell.”

Another company got in touch having already lost US$15,000 on a mask deal, after the seller vanished upon receiving the money, according to Harris.

How to properly remove and discard face masks to reduce the risk of infection

They were then approached by a Shenzhen-based firm selling PPE, presenting a document purportedly from the US Food and Drug Administration – which has been seen by the South China Morning Post – that was registered to a company in Anhui province in eastern China.

“It looked sketchy – it didn't look right,” said Fred Rocafort, another Harris Bricken lawyer. “I did a Google image search, and it turns out to be a fake certificate already used in a fraud in New Jersey. Some fraudsters are not even trying, it’s like phishing attempts where they just send the email but don’t even change the name.”

Even for those accustomed to doing deals in China, the breakneck pace of the past three months has been difficult.

David Sun runs a logistic company in the Chinese trading hub of Yiwu, but started using his export license to trade medical supplies after the outbreak went global in February.

In March, he tried to visit a factory in Shanghai to buy N95 masks approved for sale in the United States, but was blocked by police officers, “trying to stop the scalpers from entering”.

“I managed to find a middleman, who claimed he had contacts and could get masks for me,” Sun said. “The minimum order was 1 million pieces at about 13 yuan (US$1.84) each. I agreed, but within five hours, the price had risen to 15 yuan a piece, at which point I said goodbye.”

For foreign buyers, meanwhile, the price of basic surgical masks has risen from around 30 US cents to 70. The price of gloves has more than doubled, buyers said, with factories unwilling to even talk unless you order at least 100,000 pieces.

In China today, “mask machines are like cash printers”, Sun said, with “many factories manufacturing while waiting for a production license”.

Consultancy Tractus Asia has been working with US state governors’ offices to source medical equipment from China since February, and named its sourcing project Pandemonium, “because it is literally chaos”, said co-founder Dennis Meseroll.

He compared China’s ventilator market with the “Tulip Mania” that swept the Netherlands in the seventeenth century – considered by economic historians as the first ever speculative bubble, with single tulip bulbs selling for more than 10 times the annual income of a skilled craftsman, before crashing down to earth.

The price of a Chinese-made AeonMed ventilator has risen from US$10,000 a few weeks ago to US$75,000 now, according to those sourcing them.

Unlike face masks, hi-tech ventilators cannot be mass-produced, meaning the huge rush of demand as governments and hospital systems tried to bolster their inventories sent prices soaring.

Yuan Xuemeng, general manager of Chinese ventilator maker Shandong Penghao Electronic Technology, has stopped taking orders as existing orders will not be complete until the end of July. The company is contracted to sell ventilators to the Chinese government when they are needed, but otherwise to licensed traders who can export them.

It is a wild feeding frenzy, but like the Dutch tulip market, it will all come crashing down Dennis Meseroll

Numerous people familiar with the market blamed these traders for driving prices up.

“Most of the problem is caused by middle men buyers – it is a perfect storm,” said Clive Greenwood, Suzhou-based director at Wilson, Woodman & Greenwood Associates, which has been flying medical equipment to crisis points around the world.

“You have thousands of bad actors looking to make a quick buck, combined with overseas buyers who have no idea how to deal with China. They are being ripped off.”

In the case of ventilators, Meseroll said traders have essentially created secondary markets, where ownership deeds change hands numerous times before they reach the end buyer – often a hospital system or local government – at a hugely inflated price.

“It is a wild feeding frenzy, but like the Dutch tulip market, it will all come crashing down,” Meseroll said. “Traders are reselling – they’re saying you pay me and I will find some more [ventilators], but nobody is adding any value.”

How coronavirus is changing Beijing's economic strategy

A cruel twist of the pandemic is that these medical products are so urgently needed at a time when many supply lines are down, making sourcing even more expensive.

John Singleton, chairman of US-based freight forwarder Wen-Parker, has been working with private and public sector buyers to fly PPE out of China, but said he is “embarrassed when I tell people how much it is going to cost”.

The lack of passenger jets, in which 50 per cent of air cargo travels, means space on freight planes comes at a premium. “If I would have told any customers that I foresaw US$14 per kg of freight out of Shanghai, they would have said I’d been at the bar for too long last night. It was around US$2.50 before that,” he said, adding that about 90 per cent of the space on planes is taken up by PPE.

This vast confluence of issues amounts to complete chaos, where people are waking up to a new market every day, thinking on their feet, learning on the fly.

“It reminds me of battle,” said Singleton, a former US Air Force pilot. “You can plan for battles, then the real world takes over and ingenuity becomes the key. The old ways that you typically did things are just gone.”

***

The article authors:

Finbarr Bermingham has been reporting on Asian trade since 2014. Prior to this, he covered global trade and economics in London. He joined the Post in 2018, before which he was Asia Editor at Global Trade Review and Trade Correspondent for the International Business Times.

Cissy joined the SCMP in 2019. Prior to that, she has been a producer at BBC News and investigative reporter at CaiXin Media. She is interested in China's politics and economy.

***

Share the link of this article with your facebook friendsFair Use Notice

This site contains copyrighted material the

use of which has not always been specifically authorized by the copyright

owner. We are making such material available in our efforts to advance

understanding of environmental, political, human rights, economic,

democracy, scientific, and social justice issues, etc. We believe this

constitutes a 'fair use' of any such copyrighted material as provided for

in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C.

Section 107, the material on this site is

distributed without profit to those

who have expressed a prior interest in receiving the included information

for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

If you wish to use copyrighted material from this site for purposes of

your own that go beyond 'fair use', you must obtain permission from the

copyright owner.

|

|

|

|

||

|

||||||