www.aljazeerah.info

News, September 2019

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

|

Editorial Note: The following news reports are summaries from original sources. They may also include corrections of Arabic names and political terminology. Comments are in parentheses. |

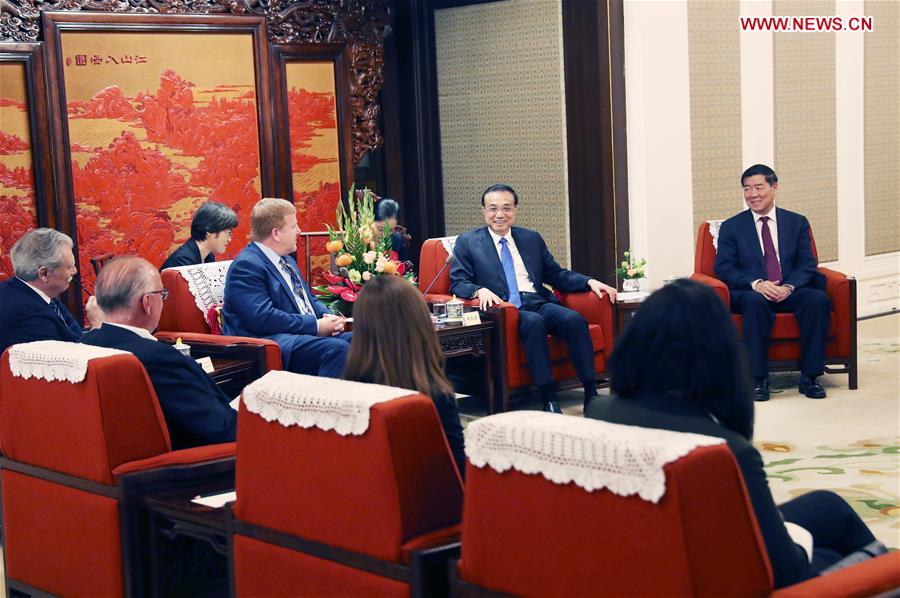

Chinese Premier Exchanges Views with US Entrepreneurs and Former Officials on US-China Trade War

September 10, 2019

|

|

|

Chinese Premier Li Keqiang meets with an American delegation visiting China for a dialogue with Chinese entrepreneurs and exchanges views with them on China-U.S. trade relations in Beijing, capital of China, Sept. 10, 2019. The delegation consists of U.S. business entrepreneurs and some former high-level officials. (Xinhua/Yao Dawei) |

Chinese premier exchanges views with U.S. entrepreneurs on trade

Source: Xinhua| 2019-09-10 23:48:55|Editor: huaxia

BEIJING, Sept. 10 (Xinhua) --

Premier Li Keqiang on Tuesday met with American delegation visiting China for a dialogue with Chinese entrepreneurs and exchanged views with them on China-U.S. trade relations.

The delegation consists of U.S. business entrepreneurs and some former high-level officials.

This year marks 40th anniversary of the establishment of diplomatic relations between the People's Republic of China and the United States. Over the past 40 years, the two countries have witnessed forward-moving economic and trade ties with win-win results, Li said.

While stressing the importance of extensive common interests between China and the U.S., Premier Li suggested that both sides, in accordance with the consensus reached by the two heads of state, should follow principles of equality and mutual respect, seek common ground and continue to explore approaches accepted by both sides to resolve differences.

China will open only wider to the outside world, and is committed to creating a market-oriented, law-based international business environment where domestic and foreign enterprises are treated equally and protection of intellectual property is given priority to.

China has fully liberalized its manufacturing sector and accelerated the opening up of its service sector, the premier said.

"China has a vast market. We welcome enterprises from all countries, including those from the United States, to expand economic, trade and investment cooperation with China and achieve mutually beneficial results," Li added.

The American entrepreneurs said that U.S. companies, which were inspired by China's new measures to open up, are looking at the current U.S.-China trade frictions from a long-term perspective, opposing actions to weaken economic relations with China and economic decoupling between the two countries.

They also voiced their hope that bilateral economic and trade consultations will gain ground with an agreement being reached at an early date.

***

Tariffs Are Starting to Hit Sellers on Amazon

Amazon sellers feeling the heat of US-China trade war, contrary to Donald Trump’s claims, survey shows

Jungle Scout survey shows 72 per cent of sellers have seen their cost per unit increase by some 17 per cent since the beginning of the trade war last year First round of new US tariffs took effect on about US$110 billion of Chinese imports on September 1, with more to follow in October and December

10 September, 2019

South China Morning Post --

Link Copied The survey findings contrast with US President Donald Trump’s claims that the trade war has not affected prices paid by American consumers. The US president tweeted on August 19: “import prices down, China eating tariffs”. Photo: Reuters

American third-party vendors who sell on Amazon, the world’s largest e-commerce platform by revenue, singled out tariffs imposed by the United States on Chinese goods as the main reason their costs are increasing, slashing their margins and forcing them to push up prices on consumers, a new survey revealed.

Some 72 per cent of Amazon sellers have seen their cost per unit increase by around 17 per cent since the beginning of the trade war last year, according to a survey of Amazon vendors conducted by Jungle Scout, a company which helps third-party sellers set up their businesses.

The survey findings contrast with comments from US President Donald Trump, who said the trade war has not affected prices paid by American consumers, with a tweet on August 19 saying that “import prices down, China eating tariffs”.

American retailers and consumers are most worried about the imposition of a new 15 per cent tariff on consumer goods.

The new tariff took effect on the first batch of items, about US$110 billion of Chinese imports – including plastic tableware, toys and clothing – on September 1.

Amazon sellers largely source their products from China, and they’re already feeling the pain of these new tariffs Greg Mercer

Advertisement It is due to take effect on a second, US$160 billion group of Chinese goods – including smartphones and consumer electronics – on December 15. In addition, the US will increase tariffs on US$250 billion worth of Chinese goods from 25 per cent to 30 per cent on October 1.

One survey respondent, named only as Greg by Jungle Scout, who sells a wide range of products on Amazon from kitchen utensils to outdoor furniture, said that small businesses on the platform are caught in “a guessing game,” having to choose between lowering profit margins or passing costs on to consumers — neither of which they want to do.

“Amazon sellers largely source their products from China, and they’re already feeling the pain of these new tariffs,” said Greg Mercer, founder and CEO of Jungle Scout.

One in four owners are ready to walk away from their Amazon business due to the impact of the tariffs on their costs, instead of finding a new supplier or raising their prices to survive, according to the survey of around 200 respondents.

Advertisement

“For many, these tariffs can make or break a seller’s business. Most don’t have the margins to eat the costs without cutting back in other areas of their business,” Mercer warned.

Manufacturers and suppliers in China are also seeing a decline in purchase volumes from US clients. Winnington Metal, a Guangdong-based cookware manufacturer with around 1,000 employees, is one such supplier that is beginning to feel the pain from US tariffs.

The American market accounts for 55 to 60 per cent of the company’s total sales, with orders from both the US and Europe having dropped 10 to 15 per cent amid the trade tensions, according to Shirley Liu, global sales and marketing director for Winnington Metal.

“In fact, we have already noticed that our customers have adjusted [and increased] their retail prices already, which means that US consumers are already paying more in order to get the products,” Liu observed.

Although 19 per cent of the Amazon sellers in the Jungle Scout survey indicated that they were looking to move their manufacturing to the US, their production materials still need to be imported from China or from elsewhere.

“Small business owners in the US have to either accept the tariffs or stop buying [from China], those are the two choices that they have,” said Fredrik Gronkvist, co-founder of Hong Kong-based Chinaimportal, which helps small businesses on Amazon manage their manufacturing projects in China.

According to Gronkvist, it can be difficult, especially for smaller online sellers, to move their supply chain and production to places like Vietnam or India because factories in other countries do not have the same expertise to produce goods with the same quality and low price as in China.

For smaller businesses, China is “just way more accessible,” he added. “You can’t just transplant a [manufacturing] ecosystem. There's just no replacement for China.”

This article appeared in the South China Morning Post print edition as: tariffs are starting to hit sellers on amazon

***

Trump wants US businesses to cut all ties with China: why that’s a lose-lose plan

The loss of the huge Chinese market and supply chains would hit US firms and consumers hard. China’s strengths and a tech boost would see it bounce back, while service-oriented America would face long-term suffering and sustained decline

SCMP Columnist: Winston Mok ,

11 September, 2019

Link Copied US President Donald Trump arrives at a US military base in Houston, Texas, in May 2018. The US simply cannot replace, or find viable replacements for, China’s huge and uniquely competitive production machinery without taking major steps backwards. Photo: AFP Donald Trump has “ ordered ” American companies by tweet to stop doing business with China. Even with the US president’s shifting whims , what if his wish were to come true?

In an extreme scenario, if US-China trade and US manufacturing in China were to grind to a halt – when US companies no longer had any business with or in China – what would be the implication for American consumers, its companies, workers and innovation?

US consumers would suffer considerably, with a narrower selection of shoddier goods costing more, driving up inflation.

AdChoices ADVERTISING inRead invented by Teads Had Trump not delayed tariffs for the not-yet-targeted Chinese goods until mid-December, US consumers would have had a foretaste of US-China decoupling this Christmas . Advertisement READ FULL ARTICLE

Without the Chinese supply chain and the vast China market, many US companies would be displaced by non-US rivals. In decoupling, the US would not be isolating China, but itself, from the global production network.

Could Vietnam and Mexico replace China? Not for the breadth and depth of goods made in China, nor for the price, quality and value combination. Advertisement Smuggling into the US of otherwise legitimate consumer items would be rampant. Shopping trips to Canada and Mexico would become popular. US consumers would face a declining standard of living. The middle class and the working class would be hardest hit. SUBSCRIBE TO Opinion Get updates direct to your inbox By registering, you agree to our T&C and Privacy Policy Thank you for your subscription. You can also view our other newsletters.

American companies, without access to the world’s most important supply chain , would lose out in competitiveness. In the global production system, China cannot be replicated even if there were 10 Vietnams working in concert over a long period. Many American firms would see their market positions in China taken over by their German , Japanese, Korean or Chinese counterparts. Without the China market, some leading US companies would be greatly diminished, even if they could remain viable. Advertisement Many US workers, including those in the retail and manufacturing sectors, would lose their jobs. The days when Chinese manufacturing jobs could return to the US are long gone – many of those jobs cannot even stay in China, while workers are being replaced by robots in some cases.

Some Chinese jobs would go to other parts of Asia and Africa, often in Chinese-owned factories.

The US economy would become less innovative. From Boeing to Hollywood studios, US companies would be left with much-reduced revenues to support innovation.

Being denied access to China-made components would mean the US was not a viable start-up location for many hardware-based ventures.

Many start-ups already find the supply ecosystem in Shenzhen more effective than that of Silicon Valley. China and the likes of Singapore may become more attractive innovation hubs at the expense of the US.

The US owes its dynamism to attracting the best and brightest from the world to its open economy.

In decoupling from China, it would become a far less attractive destination for global talent – as it would cease to be a place where global resources may be effectively marshalled to facilitate innovation in many fields.

America would lose key ingredients which make it great. The US has some unassailable edges over China: radical innovation and draw for global talent.

A key motivation for recent American moves against China has been sustaining US economic dominance by containing China’s rise. Decoupling the US economy from China’s would have the opposite effect – by undermining its key advantages over China.

The impact of any such decoupling on China’s manufacturing would be huge.

Many Chinese companies, mostly smaller and weaker ones, may go out of business – resulting in a significant contraction of manufacturing capacities. With consolidation in many industries, only the stronger companies would remain.

Without access to US technologies, many Chinese firms would suffer, especially if no alternatives could be found in Europe or Asia. But that would only accelerate technology development in Chinese companies.

In contrast with Americans, Chinese consumers would be affected little. They may face fewer food varieties and slightly higher food prices. With plenty of alternatives, from Australia to France, there may not be a revolt among the Chinese affluent class if they cannot drink Californian wine.

In fact, Chinese consumers may enjoy even lower prices, higher quality and a wider product range as China’s vast production capacities turn domestic.

The key divergence is between workers in the two countries. In the US, many high-end jobs would disappear while some low-end jobs may become available. US companies with good knowledge-based jobs, hitherto leveraging China’s supply chain and its vast market, would wither.

In China, many low-end jobs would vanish while more high-end jobs would be created. High unemployment in the immediate aftermath of decoupling would be followed by the creation of high-value jobs in due course.

While economic coupling has boosted China’s development, it has also kept the US on top. Decoupling would do the opposite.

In the context of a global slowdown or even recession, it may partially reverse the relative decline of Europe and Japan, and spread the growth among developing economies. More than slowing China for a time, it would hasten the US’ decline.

As the economies of US and China decouple, both nations would suffer tremendously but their destinies would diverge. One would face immediate quantitative contraction while the other would see long-term qualitative decline.

The reason is simple. With its unrivalled manufacturing base and vast market, China can hope to catch up with US technologically, albeit with high risks and uncertainties.

As a service-oriented economy, the US simply cannot replace, or find viable replacements for, China’s huge and uniquely competitive production machinery without taking major steps backwards.

Without the Chinese supply chain and the vast China market, many US companies would be displaced by non-US rivals. In decoupling, the US would not be isolating China, but itself, from the global production network.

In a bifurcated world, the US would suffer long-term and sustained decline in its economic competitiveness and standard of living.

Winston Mok, a private investor, was previously a private equity investor

***

Share the link of this article with your facebook friendsFair Use Notice

This site contains copyrighted material the

use of which has not always been specifically authorized by the copyright

owner. We are making such material available in our efforts to advance

understanding of environmental, political, human rights, economic,

democracy, scientific, and social justice issues, etc. We believe this

constitutes a 'fair use' of any such copyrighted material as provided for

in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C.

Section 107, the material on this site is

distributed without profit to those

who have expressed a prior interest in receiving the included information

for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

If you wish to use copyrighted material from this site for purposes of

your own that go beyond 'fair use', you must obtain permission from the

copyright owner.

|

|

|

|

||

|

||||||