www.aljazeerah.info

News, April 2015

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

|

Editorial Note: The following news reports are summaries from original sources. They may also include corrections of Arabic names and political terminology. Comments are in parentheses. |

Greek-Russia Ties Bloom as Greek Default Looms

April 27, 2015

|

|

| Alexis Tsipras and Vladimir Putin during signing of agreements in Moscow, April 8, 2015 |

Greek-Russia ties bloom as default looms

By Andrew Hammond April 27, 2015

Greek Prime Minister Alexis Tsipras and Gazprom CEO Alexei Miller agreed last week on a “roadmap” for a multi-billion dollar pipeline project to transport gas from Russia to Greece. The long-term plan is a further sign of warming geopolitical ties between Athens and Moscow, at a moment when the Greek economic crisis appears to be worsening.

In effect, Greece is now engaged in a very high stakes game of poker. It has issued a legislative decree to tap pockets of cash reserves across the public sector and has reportedly made plans to potentially nationalize the banking sector and introduce a parallel currency to pay bills in the event its cash reserves are exhausted.

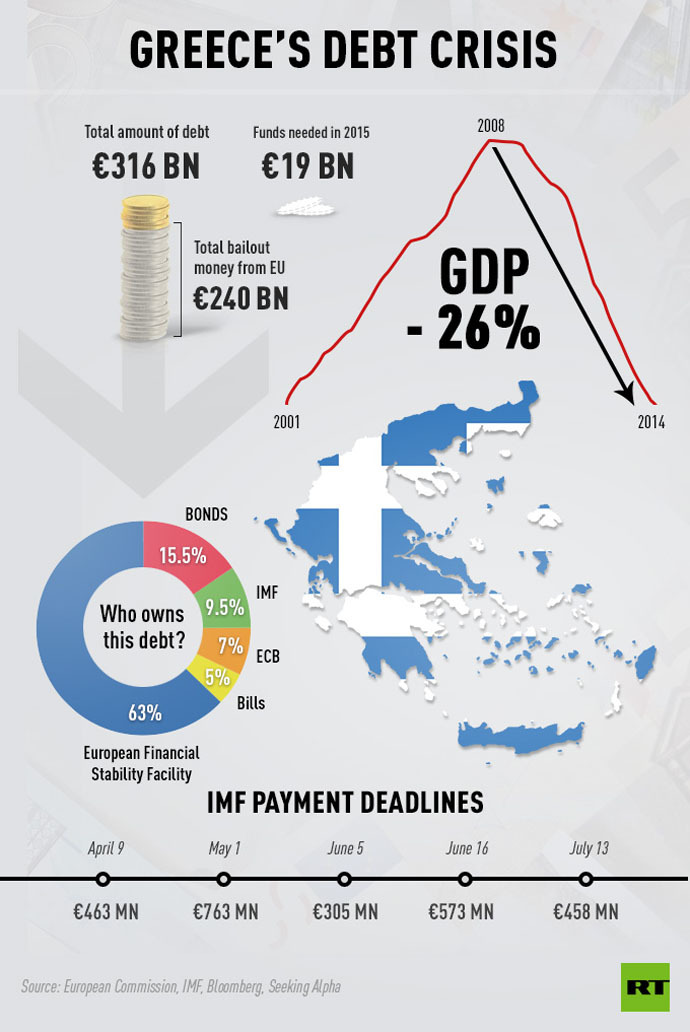

Tsipras insists he wants Greece to keep the euro, but doesn’t appear to have a clear strategy for negotiating with international creditors. What he has warned repeatedly of are “major clashes” that are needed with these creditors to ease the country’s debt burden which is over a staggering 175 percent of its GDP.

Earlier this month, he also agreed to meet Russian President Vladimir Putin. The session, billed as routine, had originally been planned for May but was brought forward, serving as a prelude to the meeting between Tsipras and Gazprom over the pipeline roadmap.

While most Greek officials have dismissed the idea of receiving wider Russian aid, Defence Minister Panos Kammenos has floated the idea in public. And Russian Foreign Minister Sergei Lavrov has indicated that Moscow would consider such a request were it made.

The meeting with Putin was most likely an attempt by Tsipras to raise pressure on Greece’s creditors. It and the announcement of the pipeline roadmap will raise fears in some circles of a potential pivot toward Moscow in the event that relationships between Athens and its creditors break down completely.

While the intensifying crisis in Greece could yet be resolved before the May deadline for repayments to the IMF, this is far from sure. And no developed country has ever fallen into arrears to the IMF or any other Bretton Woods institution. Greece appears perilously close to risky and uncharted territory.

Which, in turn, raises the issue of potential Greek exit from the euro (the so-called Grexit). The prospects for such a rupturing of the euro zone have grown since Greece’s January election, when a radical-left party won power for the first time in the EU in years.

The party, Syriza, comprises a broad spectrum of socialists and communists, anti-fascists, environmentalists, anti-globalization campaigners and human rights advocates. And it is, notably, staunchly anti-austerity.

As Syriza fell just short of an absolute majority in the Greek Parliament in January’s elections, it formed a coalition with the conservative Independent Greeks party, which shares a strong anti-bailout position. This has reinforced Syriza’s instincts that the country’s economic “humiliation” must come to an end.

But while the possibility of a Grexit cannot be dismissed, it’s hard to predict what its impact would be.

Today, more than 80 percent of Greece’s public debt is owned by institutional investors, whereas private investors held the vast bulk of Greek bonds in 2011. This may reduce the likelihood of further turmoil in Athens spreading significant contagion through the euro zone.

But even under the mildest of financial stress scenarios, it is estimated there would potentially be a contraction in euro zone GDP of at least 1.5 percent. This is greater than the current contribution of the Greek economy.

Perhaps most striking, Grexit would show that euro zone membership is reversible, changing investor perceptions of risk.

Whether or not Grexit happens, increased saber-rattling from Athens could heighten investor fears about the strength of populist and euroskeptic parties across the EU. In this respect, the Greek election result may represent only the first rumblings in 2015 of potential political and economic earthquakes on the European horizon.

Here is what you need to know about Putin's meeting with Tsipras

Greek Prime Minister Alexis Tsipras will meet Russian President Vladimir Putin on Wednesday. Greece could ask Moscow to bankroll a bailout, Gazprom could agree to a gas discount, or the two sides could talk about how to sidestep EU sanctions.

The new 40-year-old leader of one of the world’s most indebted countries with meet with Putin on Wednesday, just one day before the country is due to repay €463.1 million to the International Monetary Fund. The Greek Prime Minister arrives in Moscow on Tuesday.

Is Russia going to bail out Greece?

Rumors have been abuzz that Athens and Moscow are plotting a secret bailout ever since the idea was first floated by Russian Finance Minister Anton Siluanov days after the Syriza party won the elections in January. Russian daily Kommersant reported that Moscow is ready to offer indirect financial help, citing an unnamed government source.

“We are ready to consider the issue of allowing Greece a gas discount: under the contract, the gas price is linked to the oil price that has gone significantly lower in recent months,”Kommersant cited a Russian government source as saying.

“We are also ready to discuss the possibility of allowing Greece new loans. But in turn we are interested here in reciprocal moves, in particular in terms of Russia getting certain assets from Greece,” the source added, without specifying the sort of assets he was talking about.

Greek Finance Minister Yanis Varoufakis has said that his country “will never ask for financial assistance from Moscow,” in an interview with Zeit online in early February.

Wait, does Russia have the money for this?

Yes and No.

Government officials have hinted that Russia’s help, if provided, would be indirect.

Most economists around the world are more positive about the Russian economy, but everybody agrees it will contract this year between 4 and 3 percent. Most recently S&P improved its economic outlook for Russia, saying it’ll return to growth in 2016 and add 1.9 percent.

In the first quarter of 2015, the economy expanded 0.4 percent, and the Russian ruble, which lost nearly 50 percent in 2014, is now the best performing currency of the year.

Though Russia‘s economy isn’t as strong as it was two years ago, and growth is near zero, it still has $356 billion saved up in currency reserves as of April 1 and over $150 billion split between the country’s oil reserve funds, the National Reserve Fund and National Welfare Fund. If the Russian economy goes nose first into a recession, these funds are expected to keep the financial situation stable for 2-3 years.

Russia provides financial aid and loans to most former Soviet countries. In March, the Kremlin prolonged a $2 billion loan to Belarus, and in February agreed on a $270 million loan to Armenia. In 2013, just before Ukraine began its pivot towards Europe, Russia gave Kiev a $3 billion Eurobond loan.

The question isn’t if Moscow has the money but if it wants to get a ‘political dividend’ by getting another ally and sink money into Greece, which has already sucked up €240 billion in EU debt and hasn’t posted GDP growth in six years.

What about a gas discount for Greece?

Gas has become an important issue in economic relations between Russia and Greece, after President Putin announced the new Turkish Stream pipeline that will travel to the Turkish-Greek border. Both Russia and Greece are interested in the project but Athens’ stance largely depends on the gas price Russia will offer.

On March 30, Greek Energy Minister Panagiotis Lafazanis met with Russian counterpart Aleksandr Novak as well as Gazprom head Aleksey Miller in Moscow to discuss a gas discount for Greece as well as the ‘take-or-pay’ clause, which requires Athens to buy gas it doesn’t use.

Under the current contract, Greece’s state gas company DEPA buys gas at $300 per 1,000 cubic meters. In 2014, DEPA was able to secure a 15 percent discount from Gazprom. Greece may be able to secure a further discount or renegotiate the ‘take-or-pay’ part of the contract if Athens offers Russian companies oil assets or rights to explore oil and gas deposits in the Ionian Sea.

In 2013, Gazprom made a €900 million bid to buy a controlling stake in DEPA, but backed out of negotiations at the last minute, citing concerns over the company’s financial stability. Gazprom currently controls almost 70 percent of the Greek gas market.

During the talks, Lafazanis also discussed the prospect of Greece joining the Turkish Stream pipeline project, which will have the potential to deliver 47 billion cubic meters of gas to Europe via Turkey. Gazprom said the onshore route will pass through the Black Sea and reach the Turkish port of Kiyikoy, and then travel to the Turkish-Greek border near the town of Ipsila.

Can Moscow lift sanctions on Greece?

Russia’s agriculture counter-sanctions against the EU do not expire until August 2015, a year after they were enacted as a counter measure to protect Russia’s economy.

Greece has been hit especially hard by Moscow’s food ban, as more than 40 percent of Greek exports to Russia are agricultural products. In 2013, more than €178 million in fruits and conserves were exported to Russia, according to Greece’ fruit exports association, Incofruit-Hellas.

Russian Minister of Agriculture Nikolai Fyodorov has said food sanctions against Greece would be lifted in the event that Athens leaves the EU. While Greece is a part of the EU, it cannot sign any trade agreements with Russia.

As an EU member, Greece has the power to veto further sanctions against Russia. Alexis Tsipras has openly said that sanctions against Russia are a “road to nowhere”. Other Moscow-friendly states include countries with very close economic ties to Russia- such as Hungary, Slovakia, Italy, and the Czech Republic.

Russia is Greece’s biggest trading partner, with net trade in 2013 nearly $12.5 billion (€9.3 billion), more than Greece and Germany in the same year. Russia is the biggest source of imports for Greece, accounting for 11 percent in 2013.

Once Russia’s food market is again open, Greece, along with Turkey and Cyprus, will be the first to re-enter, according to Sergey Dankvert, head of Russia’s food inspector, Rosselkhoznadzor,

After the trip, what’s next for Greece?

While Tsipras is still in Moscow, Greece is expected to make a €463.1 million payment on IMF loans. By the end of May, another €768 million is due.

If Varoufakis goes back on his statement and Greece does default on its loans from EU creditors, leave the eurozone and shared currency, and then ask Moscow for a few billion to get by - the situation would shock almost everyone and spark chaos across financial markets since Greece has repeatedly said it intends to pay off its massive €324 billion debt.

READ MORE: Greece demands €278bn WWII reparations from Germany - more than its debt to EU

The reason the EU came to Athens’ rescue with two bailouts totaling €240 billion was to protect the euro currency, which is shared by 18 countries including Greece.

So far, Athens has signaled it wants to keep borrowing from the EU, but just under different terms. If for some reason Greece decides to default on its IMF debt, it would be the first developed country to ever do so.

The Greek economy hasn’t expanded since 2008 and has rapidly come to a grinding halt under stringent EU conditions.

Greece was given a four month extension on its bailout plan from its lenders, and the next step will be decided after Athens can convince EU ministers they are serious about economic reform. However, ministers from Greece have said they do not intend to default on any financial obligations to their lenders.

***

Share this article with your facebook friendsFair Use Notice

This site contains copyrighted material the

use of which has not always been specifically authorized by the copyright

owner. We are making such material available in our efforts to advance

understanding of environmental, political, human rights, economic,

democracy, scientific, and social justice issues, etc. We believe this

constitutes a 'fair use' of any such copyrighted material as provided for

in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C.

Section 107, the material on this site is

distributed without profit to those

who have expressed a prior interest in receiving the included information

for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

If you wish to use copyrighted material from this site for purposes of

your own that go beyond 'fair use', you must obtain permission from the

copyright owner.

|

|

|

|

||

|

||||||